The LED display screen market in 2024 is a year of high expectations and confidence. The market will eventually have objective laws, and everything will return to normal. In the past six months, some hidden demands have emerged in the spotlight, either due to the leading mission of industry leaders or keen market opportunities. Against the backdrop of overall recovery, what changes have occurred in the LED display screen market this year? What are the new features?

The upstream enterprise market environment is good, and the display screen market pattern is stable

The upstream chip link is an important part of the LED display industry chain. Benefiting from the rapid development of the display panel industry, the global display driver chip market continues to expand, and the Chinese market has become the main market for display driver chips worldwide. The "2024-2029 China Display Driver Chip Industry Market Outlook Forecast and Future Development Trends Research Report" released by the China Academy of Commerce shows that the market size of China's display driver chips will reach approximately 41.6 billion yuan in 2023, and it is predicted that the market size of China's display driver chips will reach 44.5 billion yuan in 2024.

The changes in the upstream market also have a certain impact on the end downstream enterprises. In mid May last year, due to the rise in upstream raw material prices, more than 20 LED terminal related companies in the LED display industry adjusted their product prices by 5% to 20%, resulting in an average price increase of 6.6% in the small pitch LED display screen market in the second quarter of 2023. Other relevant institutions have analyzed that based on this year's situation, other LED display packaging manufacturers have not yet seen any price increases. However, considering the decline in corporate profits, it is expected that they will gradually follow up on price increases.

From the overall situation, although the price of LED chips fluctuates to a certain extent every year, objectively speaking, it still depends on whether some manufacturers actively reduce prices or passively reduce them. Such small fluctuations seem to have no impact on the stability of the LED chip market. And in the future, the continued expansion of LED chip production will further expand market share, which is not only good news for upstream LED display companies, but also a joyful thing for the entire LED display industry.

Overall, in the first half of 2024, with the recovery of market demand, LED display companies will quickly return to a good operating state. The national "dual carbon" strategy, domestic and foreign energy-saving and emission reduction policies, and green economy themes remain unchanged. The LED industry will continue to maintain good development opportunities, and the degree of cross-border integration with the Internet of Things, new displays, virtual shooting, and other industries will also increase day by day. The structure of LED products will continue to be optimized, and the demand for segmented fields will continue to grow. There is broad space for industry innovation and market space.

The Mini/Micro LED market continues to grow with increasing application space

Currently, the Chinese government attaches great importance to the development of new display technologies such as Mini/Micro LED, and has issued a series of policies and guidance opinions. For example, the Implementation Opinions on Promoting Future Industrial Innovation and Development explicitly mention the need to break through Micro LED technology and set development goals for 2025 and 2027. At the same time, policies such as the Action Plan for Stable Growth in the Electronic Information Manufacturing Industry from 2023 to 2024 and the Advanced Energy Efficiency, Energy Conservation, and Access Levels of Key Energy Products and Equipment (2022 Edition) have provided financial, technological, and other support for the Micro LED industry.

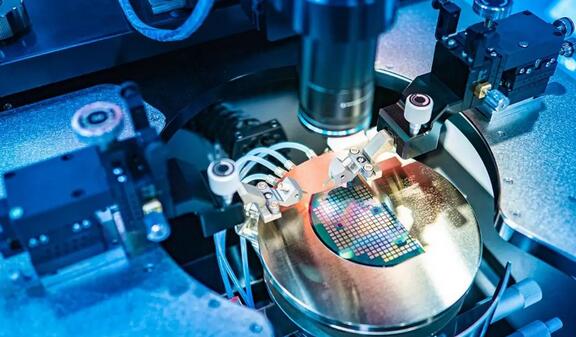

Since 2021, Mini LED technology has been the first to achieve mass production in the field of backlight products. In the two years since entering the path of large-scale development, Mini LED has gone through various development stages such as exploring technological paths, overcoming difficulties, and reducing costs and increasing efficiency in multiple dimensions. By 2023, the competitive advantage of Mini LED backlight products has been further highlighted, and the application scenario pattern has basically formed. In the high-end display market, the competition between Mini LED backlight products and OLEDs is becoming fierce. With more flexible and cost-effective technology solutions, Mini LED backlight products are accelerating their penetration into the mid to low end market to replace the existing LCD products. Data shows that in 2023, the overall shipment volume of Mini LED backlight products was about 12.59 million units, with television, displays, and car mounted as the main growth markets.

On the other hand, with the continuous increase in research and development efforts, Micro LED technology has made significant breakthroughs in high PPI, transparency, curved surfaces, narrow borders and other technological directions, possessing industry-leading technological capabilities. With the continuous maturity of technology and the integration of the industry chain, the production cost of Micro LED products has gradually decreased, providing strong support for market promotion. For example, by utilizing smaller chip area and massive transfer technology, the overall average pixel cost can be reduced, making Micro LED products more competitive.

In 2024, Mini/Micro LED, as an outstanding representative of the new generation of display technology, is leading a revolutionary change in display technology, and has shown enormous application potential in fields such as intelligent manufacturing, virtual reality, and augmented reality. It is worth noting that in the Mini/Micro LED industry chain, chip enterprises are relatively concentrated. Under the growing demand of the market, relevant enterprises actively expand their production capacity, and the packaging and module links are relatively mature, with a high degree of enterprise overlap. Among them, Mini LED backlight modules have been applied in large-scale production, and there are many entering enterprises. The industry is in a period of rapid growth.

The policy dividend is coming to an end, and differentiation strategy will be the mainstream

The development of the LED display industry economy is closely related to policies. Currently, the global economic growth rate is slowing down under pressure, and policy dividends are coming to an end, especially in the field of commercial display. At present, the dividends have not yet reached the commercial display industry, and the industrial stage has passed the period of general upward dividends. From the upward stage of taking the elevator, it has begun to shift towards a mode of load climbing and rock climbing. In the middle of the year, following the pace of Shangxian's previous shipments, most products are also gradually entering a good period. It is the peak season for project shipments, but this year, companies have reported fewer terminal demand projects, and even feel that the number of some product line projects in May and June has dropped sharply, leading to bottomless price wars. However, with the new policy dividends such as "new quality productivity", "super long term special treasury bond" and "Implementation Plan for Promoting the Updating of Equipment in the Cultural and Tourism Fields", the pull force of LED displays will be significantly enhanced.

Looking ahead to 2024, after four years of market fluctuations and slow recovery, more and more enterprises have realized deeply that they can no longer rely on waiting for the return of market dividends, relying on strong downstream demand and comprehensive high market prices to drive profitability. Instead, they should take the initiative to optimize their product structure and seize growth opportunities in market structural adjustments. On the other hand, LED screen companies have also noticed that in order to develop in the accelerated global market competition, branding is a necessary path. Differentiated technology and product innovation capabilities, as well as a mature industrial chain supply system, can enhance competitiveness in the Red Sea market.

It is expected that the US dollar interest rate hike cycle will come to an end in 2024, accompanied by major sports events such as the Olympics and the European Cup, stimulating the recovery of global consumer industries such as commerce, tourism, commerce, entertainment, retail, and hotels. The application scenarios of LED displays will be activated again, and we also look forward to the performance of LED displays in the second half of the year.

I consent to receive emails about news, marketing&product updates from Retop in accordance with the Retop Privacy Policy