The optoelectronic display industry mainly includes display panels, display modules, display materials and equipment, and the Mini/Micro LED (MLED) industry. After several rounds of technology iteration and regional transfer of production capacity, the photoelectric display industry has mostly concentrated on the Chinese Mainland market in recent years.

With the increasing maturity of the industry and the gradual saturation of production capacity, combined with the impact of the downward cycle of the optoelectronic display industry in 2022, the investment amount in China's optoelectronic display industry showed a downward trend in 2023. According to CINNO Research statistics, the investment funds in the optoelectronic display industry in China (including Taiwan) in the first half of 2023 were approximately 183 billion yuan, a year-on-year decrease of about 23%.

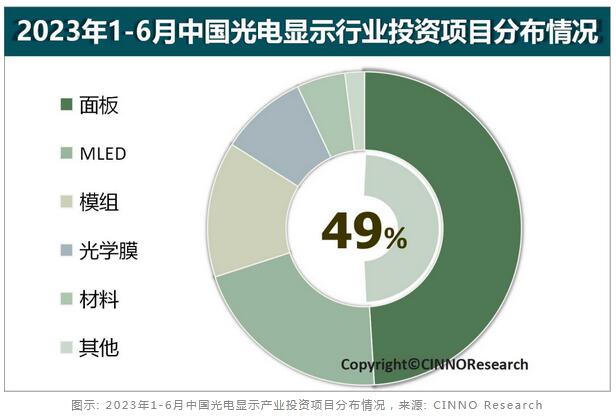

Internal fund segmentation and flow in the optoelectronic display industry:

From January to June 2023, the investment funds in China's (including Taiwan) optoelectronic display industry mainly flowed to the panel and Mini/Micro LED (MLED) fields, with a panel investment amount of approximately 89.6 billion yuan, accounting for approximately 48.9%; The investment amount of MLED is approximately RMB 38 billion, accounting for approximately 20.7%; The total investment in the module is approximately RMB 25.6 billion, accounting for 14.0%; The total investment in optical films is approximately 17 billion RMB, accounting for 9.3%; The total investment in other materials is approximately 10.8 billion RMB, accounting for nearly 6%. It can be seen that the investment in MLED projects in China continues to be hot, while the investment in materials is still dominated by optical films.

Regional distribution of investment funds for optoelectronic display projects:

From January to June 2023, the investment funds for China's (including Taiwan) optoelectronic display projects were mainly distributed in three regions: Henan, Taiwan, and Hubei, with an overall proportion of about 55.4%. Among them, the total investment amount in Henan region is about 60 billion yuan, accounting for 32.7%; The total investment amount in Taiwan is approximately 22.6 billion RMB, accounting for 12.3%; The total investment amount in Hubei region is approximately 19.1 billion RMB, accounting for 10.4%.

In terms of sub projects, the largest single investment project in the optoelectronic display industry in the first half of 2023 is the Zhengzhou Huike New Display Panel Project, with a total investment of 60 billion yuan, of which the first phase investment is about 20 billion yuan. Currently, construction has started.

Taking into account the global supply-demand balance of optoelectronic display panels, it is expected that new panel investment projects in China will be significantly reduced in the future, while the upstream and downstream supply chains surrounding the panel industry will continue to carry out relevant localization layout, thereby promoting the more competitive development of the entire optoelectronic display industry in China.

Source by:CINNO Research

I consent to receive emails about news, marketing&product updates from Retop in accordance with the Retop Privacy Policy