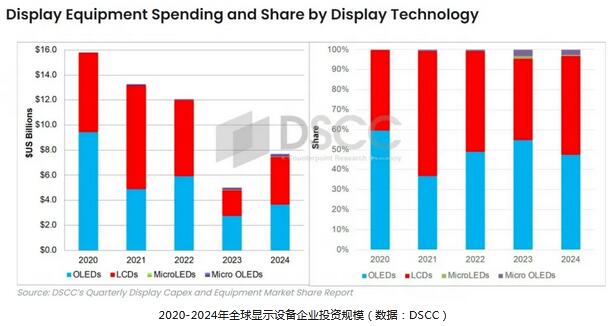

According to DSCC data forecasts, global investment in display equipment will rebound to $7.7 billion (approximately RMB 55.78 billion) this year, an increase of 54% compared to the previous year. This is half the decrease from 2020 (approximately $16 billion). Last year, this figure was $5 billion (approximately RMB 36.22 billion), a decrease of 59% from the previous year.

Previously, in December last year, DSCC predicted that global investment in display equipment would reach $4.7 billion in 2023, and then rebound to $8.5 billion in 2024. Compared with the outlook from December last year, the investment scale in 2023 increased by $300 million, while the investment scale in 2024 decreased by $800 million.

From the perspective of global display equipment investment by panel companies this year, Samsung Display is expected to occupy the largest share, reaching 31% (2.4 billion US dollars). Next is Tianma, accounting for 28% (2.2 billion US dollars), followed by BOE, accounting for 16% (1.2 billion US dollars).

From the factory perspective, Samsung's A6 IT 8.6th generation organic light-emitting diode (OLED) production line is expected to account for the largest global investment in display equipment this year, reaching 30% (2.3 billion US dollars). Next are Tianma's TM19 8.6th generation LCD factory (25%), Huaxing Optoelectronics's T9 8.6th generation LCD factory (12%), and BOE's B20 6th generation low-temperature polysilicon (LTPS) LCD factory (9%).

Among equipment manufacturers, Canon and Canon tokki are expected to account for 13.4% (1 billion US dollars) of the total amount based on imported calculations. This number has increased by 100% compared to last year. Canon Tokki ranks first in the field of vapor deposition equipment and second in the field of exposure equipment.

American equipment company Applied Materials Inc. (AMAT) ranked second with 8.4% ($650 million). An increase of 60% compared to the previous year. Next are Nikon, TEL, and V Technology from Japan. It is expected that half of the top 15 companies will see a sales growth of over 100% in display equipment compared to the previous year.

From a technical perspective, LCD equipment investment (3.8 billion US dollars, 49%) is expected to be higher than OLED equipment investment (3.7 billion US dollars, 47%). The rest is the investment in equipment required for MicroOLED and McrioLED.

IT product panel factories are expected to account for the largest proportion of display equipment investment this year, reaching 78%. The IT department accounts for 16%. From the perspective of thin film transistor (TFT) technology, oxides account for the largest proportion, at 43%. Next are amorphous silicon (a-Si), low-temperature polycrystalline oxide (LTPO), low-temperature polycrystalline silicon (LTPS), and complementary metal oxide semiconductor (CMOS). By region, Chinese Mainland accounts for 67% and South Korea 32%.

I consent to receive emails about news, marketing&product updates from Retop in accordance with the Retop Privacy Policy